Silver investment

India is seeing a big change in how people invest their money. Now, many people like to buy silver online, instead of buying real silver. This kind of digital silver is becoming very popular.

People think it's a good and easy way to invest. Digital silver investment provides investors with easy accessibility, convenience, and enhanced security compared to traditional physical silver.

The Rise of Digital Silver

Recent data highlights India is buying a lot more silver from other countries.

In the first half of 2024, India imported about 4,554 metric tons of silver. This shows that silver is becoming very popular.

Driven by industrial demand, especially in the solar energy sector, and growing investor interest in digital platforms. Investors are increasingly adopting digital silver investment due to its lower entry barriers, transparent pricing, and secure storage options.

As a result it's eliminating risks associated with physical silver, such as theft, purity issues, and storage costs.

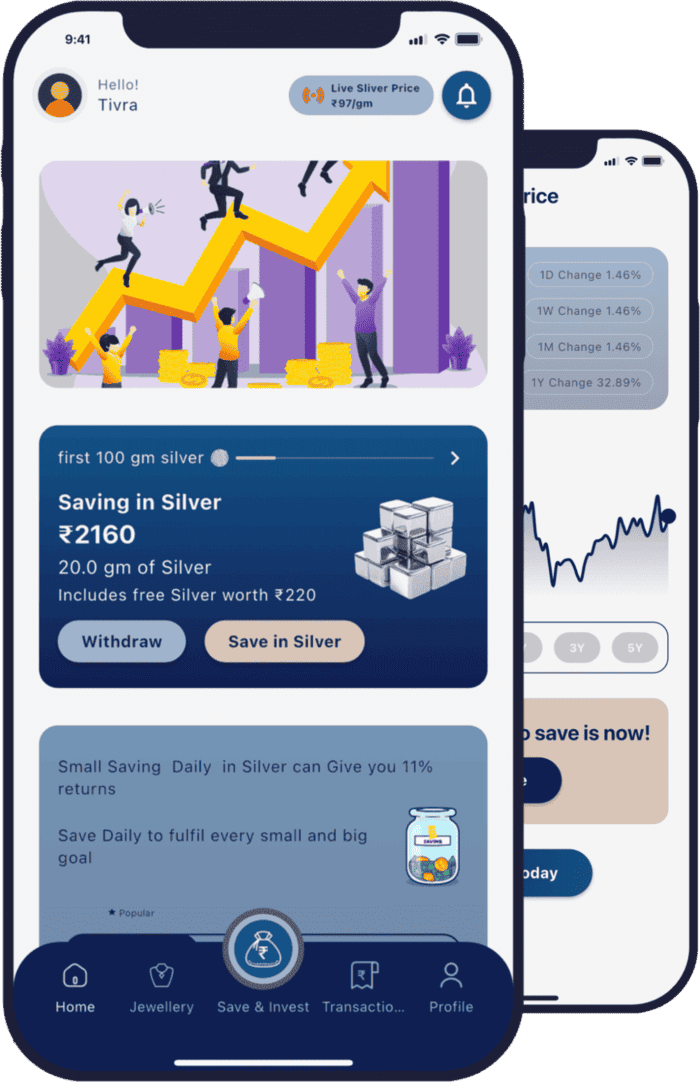

Platforms like Metra – The Silver App are changing how people invest. They make it easy to understand silver investments. You can see how your silver is doing in real-time. More young people are learning about money and investing.

Digital silver can become an important part of their investment choices in India.

Benefits of Digital Silver Investments

Technology keeps getting better. At the same time, investors are changing the way they think. Because of this, digital silver is becoming very important in India's investments. Also, digital silver is easy for investors to buy and sell. They can quickly check how much silver they have. This means they don't have to worry about storing real silver. They also don't have to worry about whether the silver is pure or not. In this way, digital silver investment solves many traditional problems.

Record High Mutual Fund Assets Under Management (AUM)

The mutual fund industry in India has grown a lot in 2024. In November 2024, the money invested in mutual funds crossed ₹68 lakh crore. This is 34% more than December 2023. Last year, it was about ₹50.78 lakh crore.

Most of this growth is because people are investing more in equity mutual funds. Equity mutual funds had ₹30.5 lakh crore in November 2024. This is almost half of all the money in mutual funds.

Rising Popularity of Sectoral and Thematic Funds

Sectoral and thematic mutual funds have seen significant investor interest in 2024.The money invested in these special mutual funds grew a lot in 2024. While in December 2023, it was ₹2.58 lakh crore. By the end of 2024, it reached ₹4.61 lakh crore. This means more people want to invest their money in special areas or ideas. People like these funds because they believe in choosing investments carefully. These developments underscore the dynamic nature of India's investment landscape. It also shows significant growth in both silver imports and mutual fund investments, reflecting evolving investor preferences and economic trends.

Introducing Metra – The Silver App

One particularly prominent platform leading this digital transformation is Metra – The Silver App. Indeed, Metra provides users with an intuitive, secure, and transparent way to invest in digital silver.

Through Metra, investors can effortlessly manage their silver investments, simultaneously tracking real-time prices and benefiting from industry-leading security measures.

Conclusion: Digital Silver's Promising Future

Therefore, it is clear that digital silver investments in India, facilitated by intuitive and secure apps like Metra. This app presents an exciting and sustainable growth opportunity.

Investors seeking reliable, secure, and modern ways to diversify their assets will undoubtedly find digital silver increasingly appealing. Ultimately, this digital shift benefits individual investors and contributes significantly to the modernization and evolution of India's overall investment landscape.